How Pvm Accounting can Save You Time, Stress, and Money.

How Pvm Accounting can Save You Time, Stress, and Money.

Blog Article

What Does Pvm Accounting Do?

Table of ContentsThe Definitive Guide to Pvm AccountingFascination About Pvm AccountingThe Single Strategy To Use For Pvm AccountingThe Ultimate Guide To Pvm AccountingUnknown Facts About Pvm AccountingAn Unbiased View of Pvm AccountingRumored Buzz on Pvm Accounting

In terms of a business's general method, the CFO is liable for guiding the business to satisfy monetary goals. Some of these approaches could involve the business being obtained or purchases going onward.

As a business expands, accountants can free up much more staff for other business responsibilities. As a construction firm expands, it will certainly require the aid of a full-time financial team that's handled by a controller or a CFO to handle the business's finances.

The Buzz on Pvm Accounting

While big services might have permanent economic support groups, small-to-mid-sized services can hire part-time accountants, accountants, or monetary advisors as needed. Was this article helpful? 2 out of 2 people located this valuable You elected. Change your response. Yes No.

Reliable audit techniques can make a substantial distinction in the success and development of building and construction firms. By applying these techniques, building and construction services can improve their monetary stability, streamline procedures, and make educated choices.

In-depth quotes and budget plans are the backbone of construction task monitoring. They assist steer the project in the direction of timely and lucrative completion while safeguarding the passions of all stakeholders included. The key inputs for project price estimate and budget plan are labor, materials, tools, and overhead costs. This is typically among the largest costs in construction tasks.

Little Known Questions About Pvm Accounting.

An exact estimation of materials required for a project will aid ensure the necessary products are purchased in a prompt fashion and in the ideal amount. An error below can result in waste or hold-ups as a result of material lack. For most building tasks, equipment is needed, whether it is bought or leased.

Do not neglect to account for overhead expenditures when approximating task expenses. Direct overhead expenses are specific to a task and might include short-term rentals, energies, fence, and water supplies.

Another variable that plays right into whether a job succeeds is an exact price quote of when the job will be completed and the related timeline. This price quote assists make sure that a project can be ended up within the alloted time and sources. Without it, a project might run out of funds before conclusion, triggering potential job stoppages or desertion.

3 Simple Techniques For Pvm Accounting

Precise task setting you back can help you do the following: Comprehend the earnings (or do not have thereof) of each project. As job costing breaks down each input into a task, you can track productivity separately.

By recognizing these items while the job is being finished, you avoid surprises at the end of the project and can deal with (and ideally stay clear of) them in future jobs. Another tool to help track jobs is a work-in-progress (WIP) routine. A WIP routine can be completed monthly, quarterly, semi-annually, or each year, and consists of task information such as agreement worth, sets you back sustained to day, complete estimated prices, and total task billings.

The Facts About Pvm Accounting Uncovered

Budgeting and Projecting Tools Advanced software program provides budgeting go to my blog and projecting capabilities, permitting building firms to plan future tasks much more properly and manage their funds proactively. File Administration Building and construction jobs involve a great deal of documents.

Improved Vendor and Subcontractor Monitoring The software application can track and take care of settlements to vendors and subcontractors, making certain timely settlements and maintaining great connections. Tax Prep Work and Declaring Accountancy software can assist in tax prep work and declaring, making certain that all appropriate economic tasks are accurately reported and tax obligations are submitted on time.

Examine This Report about Pvm Accounting

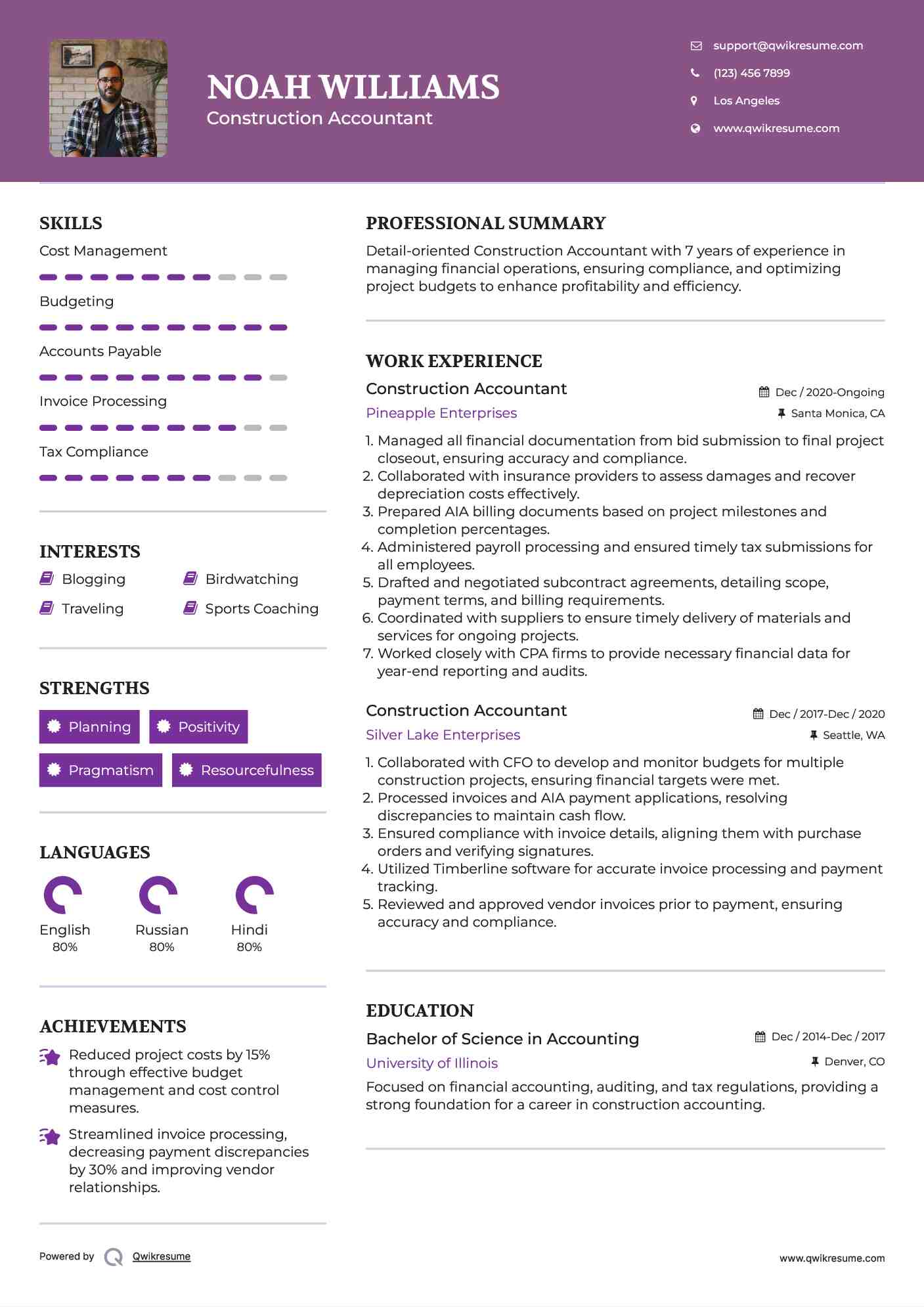

Our client is a growing development and building company with head office in Denver, Colorado. With numerous active construction tasks in Colorado, we are looking for an Audit Assistant to join our team. We are looking for a full-time Audit Assistant who will be responsible for supplying useful support to the Controller.

Receive and evaluate day-to-day invoices, subcontracts, modification orders, purchase orders, check requests, and/or other related paperwork for efficiency and compliance with monetary policies, procedures, budget, and contractual requirements. Update monthly analysis and prepares budget trend records for construction projects.

Not known Details About Pvm Accounting

In this overview, we'll dive right into various aspects of construction bookkeeping, its importance, the requirement tools used in this location, and its duty in construction tasks - https://myanimelist.net/profile/pvmaccount1ng. From financial control and cost estimating to money flow monitoring, explore how accountancy can profit building jobs of all ranges. Building accountancy describes the customized system and procedures made use of to track economic information and make critical choices for building services

Report this page